Following the wrapup of the World Economic Forum’s annual meeting in Davos and on the heels of COP28, it’s clear that the climate crisis is finally receiving the attention it deserves. Business and government leaders now face monumental challenges to contain runaway global climate change, particularly as 2023 was just named the hottest year on record.

Many conversations at Davos this year centered around the needs of the electric vehicle and battery industries to create meaningful change. Panels discussed their impact on technological innovation and economic growth, and importance for achieving the objectives of a carbon-neutral world by 2050.

Fortunately, there’s strong momentum for electric transportation and next-generation battery technologies that can extend range and reduce costs—the two factors standing in the way of mass adoption. Still, more needs to be done to advance these technologies, particularly in the burgeoning North American market, which faces a range of unique challenges.

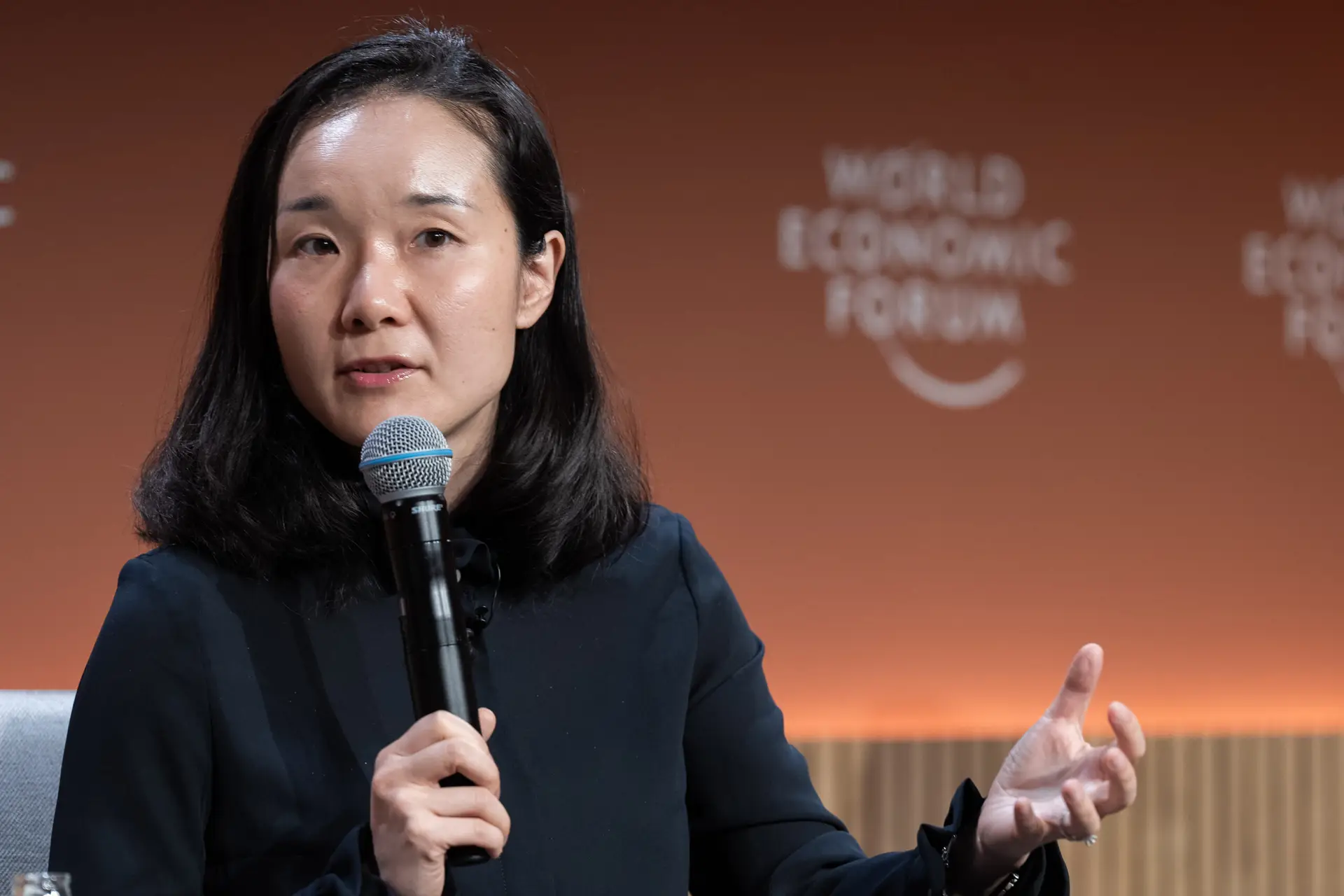

Dr. Siyu Huang at Davos 2024 speaking about how countries can overcome current trade tensions to ensure global green growth. Full video recording here.

Enhance Industry Supply Chain Collaboration, Standardization, and Transparency

Across the automotive industry, from original equipment manufacturers (OEMs) to suppliers and startups, there’s a shared recognition of the need for improved collaboration and standardization to reduce costs and enhance the sustainability of supply chains. However, efforts to increase collaboration are only beginning to gain momentum. This slow start is concerning, especially since a significant portion of a company’s emissions comes from its suppliers. In reality, emissions from a company’s own operations and the energy it purchases (known as scope 1 and 2 emissions) usually represent just 10% of its total emissions.

It is essential, then, that EV companies work closely with their suppliers to identify, prioritize, and mitigate carbon emissions. Only through enhanced collaboration that prioritizes hands-on education and verifiable results will the EV sector be able to realize full supply chain transparency and carbon neutrality.

Make Sustainability Affordable and Convenient — For Everyone

Over the past few years, EV makers have had to contend with a growing number of cost pressures, from inflationary challenges to supply chain disruptions and more. As a result of these macroeconomic headwinds and the slimmer profit margins of EVs, OEMs are currently limited in their ability to adopt additional sustainability features. Consumers too, are finding green premiums increasingly difficult to justify. While EV sales are still growing strong, the softening in demand in recent months makes clear the need for a greater focus on cost reduction and range.

Ongoing government support will be key to solving this challenge, as demonstrated by leading EV markets around the world such as Norway, which now boasts a greater than 80% EV purchase rate. Employing both sides of the ‘carrot and stick’ analogy, Norway imposed levies on internal combustion engines, reinvesting the revenues to offset tax costs for EV purchases.

Public investment is also needed to deliver timely, equitable, and economical charging infrastructure. Relying solely on commercial providers can lead to ‘charging deserts’, as urban and higher-income enclaves are favored over rural, less economically advanced communities. Plugging these charging infrastructure gaps, however, is a major opportunity for governments to advance electrification goals and charging equity while supporting EV market growth.

Finally, policymakers should look to implement other, more creative ways of improving the utility — and overall value — of EV ownership. For example by allowing EVs to bypass tolls or ride in car-share lanes, green premiums can be accompanied by more tangible, economic and convenience benefits.

Dr. Siyu Huang participating in a Davos 2024 panel about hype cycles and managing expectations amid rapid change . Full video recording here.

Build Domestic Manufacturing Competency

The U.S. is undoubtedly a global leader in battery technology innovation, with the first lithium-ion cells having been developed domestically. Despite a knack for innovation and robust market advantages, however, the U.S. hasn’t prioritized battery manufacturing (that is until recently), instead relying on foreign entities like China, Japan, and South Korea to commercialize and scale the technology. This is a major missed opportunity, as most of the product competency in batteries is developed through manufacturing know-how as opposed to initial concept origination — the complete opposite of sectors like biotech and semiconductors.

While the passage of recent legislation like the Inflation Reduction Act has been encouraging, more is needed to break the EV industry’s reliance on foreign material and equipment imports. Ongoing dependence is not conducive to nation-wide transportation electrification — the largest source of emissions in the U.S. — as American drivers require unique accommodations that demand the highest-quality batteries.

In particular, they want EVs with longer, more reliable ranges, as the average American commutes more than 40+ miles everyday. Additionally, as U.S. consumers prioritize the convenience offered by mid-to-large sized SUVs and pickup trucks (which are heavier by default), high-efficiency and lightweight materials are crucial. To top matters off, the U.S. is far more dispersed — with fewer public transportation options — resulting in a greater dependence on personal vehicles usage.

A systematic approach to building greater industrialization and hardware engineering competencies in EV manufacturing will pay dividends for the U.S. market in the long run, and will be critical to delivering the EV products that consumers will pay for.

North America is in the midst of a major economic and technological transformation away from the internal combustion engine. In an effort to maintain momentum and mitigate potential constraints, the U.S. EV industry should look to develop robust supply chain partnerships, push for strategic public investments into infrastructure, and invest in domestic manufacturing capacity.